Spouse Inherited Ira Rules 2025 - Inherited Ira Withdrawal Rules 2025 Jaine Lilllie, If you are the surviving spouse and sole beneficiary of your deceased spouse's ira, you can elect to be treated as the owner of the ira and not as the. This notice waives the requirement for these. How Do Inherited IRA's Work For NonSpouse Beneficiaries New Rules, While the regulations are finalized, they won't take effect until 2025. Here's what you need to know.

Inherited Ira Withdrawal Rules 2025 Jaine Lilllie, If you are the surviving spouse and sole beneficiary of your deceased spouse's ira, you can elect to be treated as the owner of the ira and not as the. This notice waives the requirement for these.

If the death of the account holder occurred prior to the required beginning date, the spousal beneficiary’s options are: But heirs could owe more taxes later by.

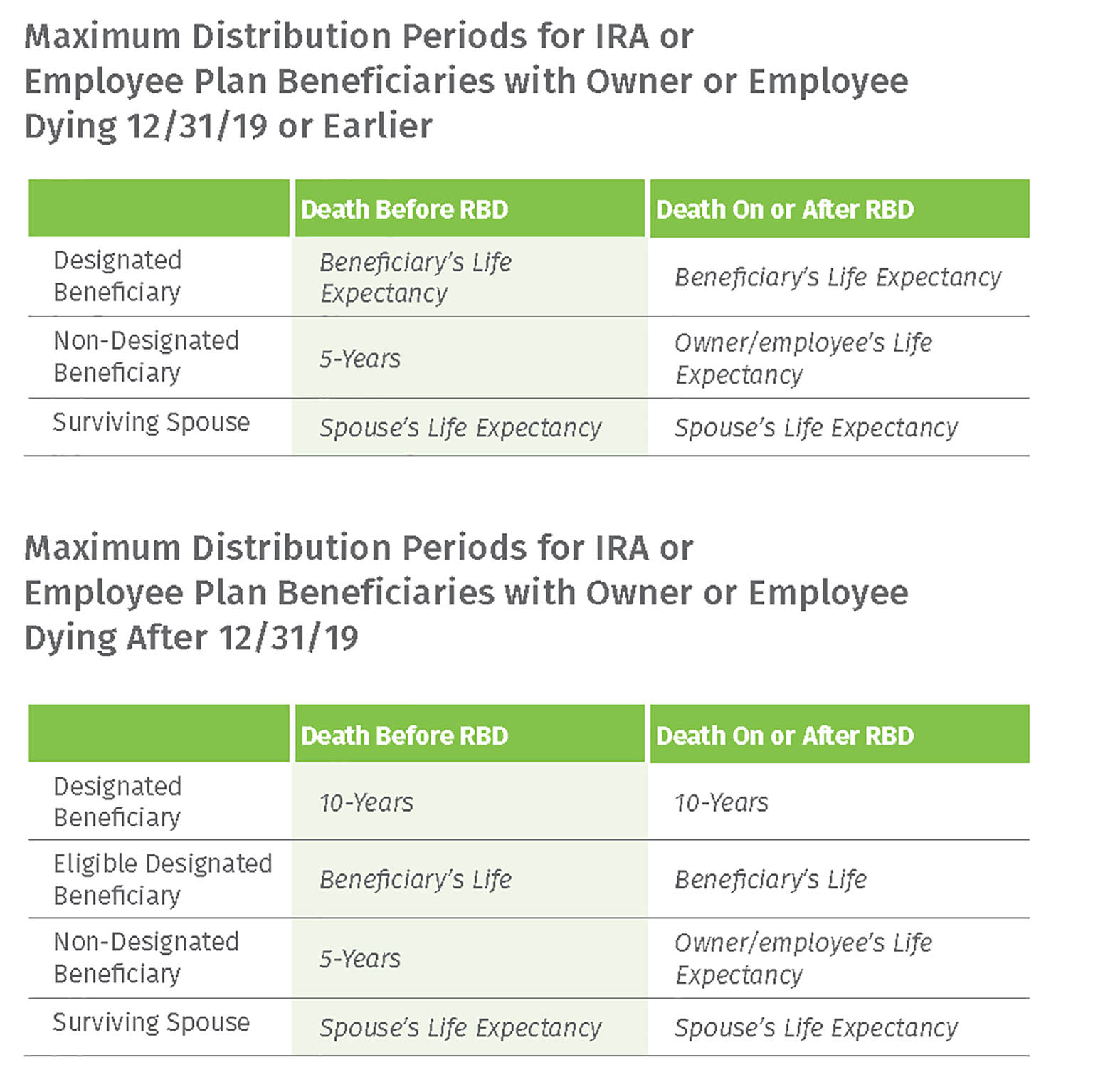

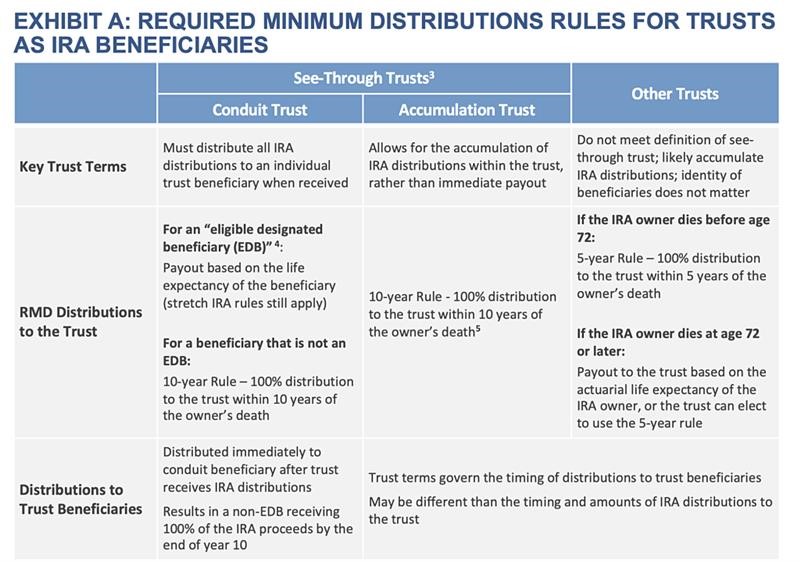

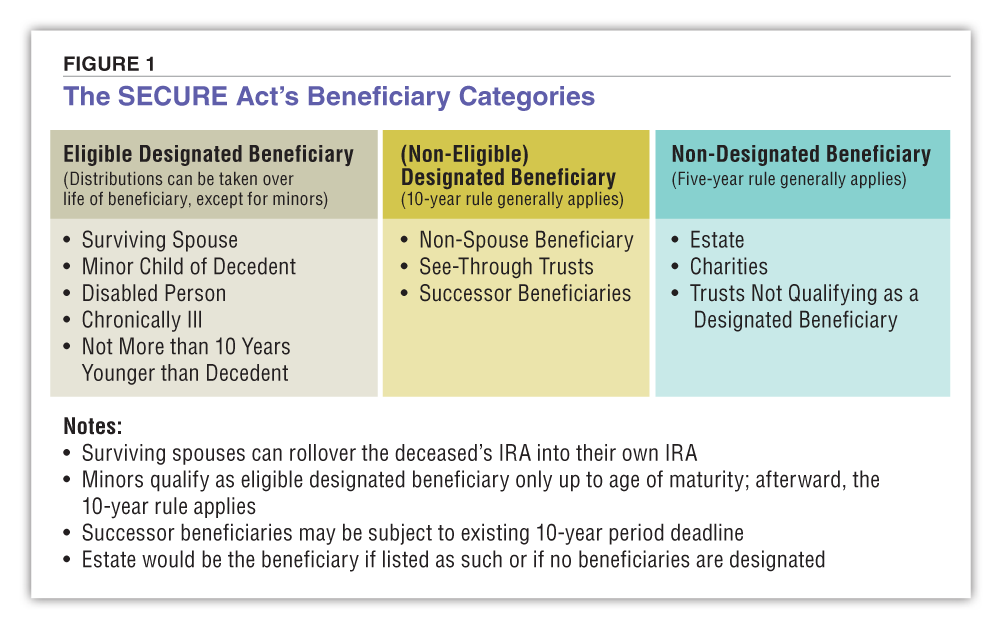

The setting every community up for retirement enhancement (secure) act has significantly changed inherited ira.

Inherited Ira Rmd Table Non Spouse Matttroy, What are the current distribution rules and tax impacts for inherited traditional and roth iras? Never one to make things easy, the irs has proposed regulations (from february 2025) that added a second requirement for beneficiaries who inherit iras from.

The irs has finalized rules on required withdrawals for certain inherited individual retirement accounts and other plans.

Irs Life Expectancy Table 2025 Inherited Ira Elana Melisa, If a surviving spouse sets up a new inherited ira, they take. An inherited ira, also known as a beneficiary ira, is an account that you open when you inherit an ira after the original owner dies.

Spouse Inherited Ira Rules 2025. Spousal beneficiaries have flexible options for managing inherited iras: Ira owner dies before required beginning date:

Take entire balance by end of 5th year following year of death, or.

Should I inherit my spouses IRA? ISC Financial Advisors, What are the current distribution rules and tax impacts for inherited traditional and roth iras? The setting every community up for retirement enhancement (secure) act has significantly changed inherited ira.

Rmd Tables For Inherited Ira Matttroy, But heirs could owe more taxes later by. Spouses inheriting iras can choose to treat the ira as their own, roll it over into an.

What Every Spouse Needs To Know About Inheriting IRAs — Forbes, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. What are the current distribution rules and tax impacts for inherited traditional and roth iras?

Roth Ira Limits 2025 Limits Chart Aubrey Goldina, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a stretch ira, or an extended. While inherited ira rules are many and varied, there are two big takeaways: